This is a guide to help beginners interested in Bitcoin and cryptocurrency get a start with basic concepts and a jumping off point to get more involved in the technology. This is not investment advice.

I aim to keep this guide simple, but I also want to protect you as a new user of cryptocurrency.

If you spend even just an hour learning about Bitcoin and exploring some of the links here on your own, you will avoid a lot of pitfalls and potential problems. A great way to learn is to make mistakes, but making mistakes with money isn’t fun for anyone, right? You can learn a lot from people who have already been down those roads before.

Hopefully this guide and overview will help you understand the benefits of Bitcoin, some of its basic functionality and help to avoid common mistakes. If you’re interested, you’ll find yourself researching more and more about it.

Full Disclosure: The only benefit I receive from this guide is maybe some traffic to my website, and the potential of turning other people into Bitcoin believers.

Bitcoin is not run by a company, government, or any centralized organization so I’m not getting paid to push its merits. I simply believe in the technology and what it has to offer and want to share that with others who are curious but may not know where to start.

Be Your Own Bank

Bitcoin is a digital currency, more specifically classified as a cryptocurrency because it heavily relies on cryptography in the way it is designed and functions. Bitcoin is sound money, because there are rules that govern it that are built into its code to make its system run and those rules cannot be changed.

Also, with Bitcoin, you’re completely in charge of your own money. One of the mottos of Bitcoin is you can “be your own bank.”

That’s a double edged sword. Traditional (legacy) financial institutions and payment networks like banks, credit cards and Paypal, for example, provide user protections. If something goes wrong, there are usually ways to get your money back. Banks have government insurance. Paypal has dispute resolutions. Credit card transactions can be reversed.

These things don’t exist in Bitcoin.

In reality, sometimes these protections that legacy financial services offer can be burdensome to one or another party in a transaction.

That’s one of the reasons why Bitcoin was created. And Bitcoin comes with other protections.

If you live in a country with an oppressive or restrictive government, or without modern infrastructure that provides easy access to banking, then finances can be difficult.

Bitcoin can solve that. Because Bitcoin doesn’t rely on the permission of governments, large financial institutions, any companies, or any central organizations at all, transactions can be sent anywhere in the world and they cannot be stopped.

Bitcoin has even been sent over radio waves and via satellites.

Even if you don’t have problems with access to banking, Bitcoin is an amazing technology for a lot of other reasons and that’s why many people believe it has huge potential for the future.

Why Bitcoin Is Great

“Bitcoins have all the desirable properties of a money-like good. They are portable, durable, divisible, recognizable, fungible, scarce and difficult to counterfeit.”

– Official Bitcoin Wiki

Bitcoin is a powerful technology for many reasons, here are just a few:

It’s decentralized because it runs on a distributed network. Anyone can read and run the code and computers all over the world are running what comprises the bitcoin network, so it can’t be shut down at one location. You’d have to shut down the entire internet or millions of individually owned computers to stop Bitcoin. That’s not something likely to happen – it’s very unfeasible.

Transactions are irreversible. Once someone sends you money, they can’t take it back. There is no way to undo a transaction.

It’s private. While Bitcoin is not completely untraceable, it is pseudonymous. Bitcoin uses cryptography for security. Hence the name cryptocurrency.

It’s trustless. You don’t need to trust a bank or another organization with your money. You are in complete control when it comes to Bitcoin.

It’s open source. Anyone can read the source code and understand how it works.

Permission-less. You don’t have to have a company’s approval to use Bitcoin. You don’t need to sign up or meet any requirements to use Bitcoin, and no one can shut down your “account.”

Global. It works anywhere in the world and can’t be stopped by borders.

Low cost. The only fees to use it are minimal fees used to help keep the network online and running.

Flexible. Not only can it be sent quickly and with minimal effort, but as a currency, Bitcoin is divisible currently to 8 decimal places. You don’t need to buy a full Bitcoin, you can transact in fractions of a Bitcoin down to very small amounts.

You may or may not be interested in economics. But Bitcoin and the way it came into being, and even how it operates today, is intrinsically tied to philosophical concepts of economics and free markets. The technology that drives it also has a lot to do with computer science.

We’re still in the early days of Bitcoin and cryptocurrency, but even so, much has changed since the very first days of Bitcoin and more and more progress is happening every day.

How does Bitcoin work?

“Bitcoin uses public-key cryptography, peer-to-peer networking, and proof-of-work to process and verify payments.”

– Official Bitcoin Wiki

Here’s my own explanation of how Bitcoin works. There are some concepts I combined to make it easier to understand for a beginner, but I’ve compressed them for the sake of brevity and simplicity:

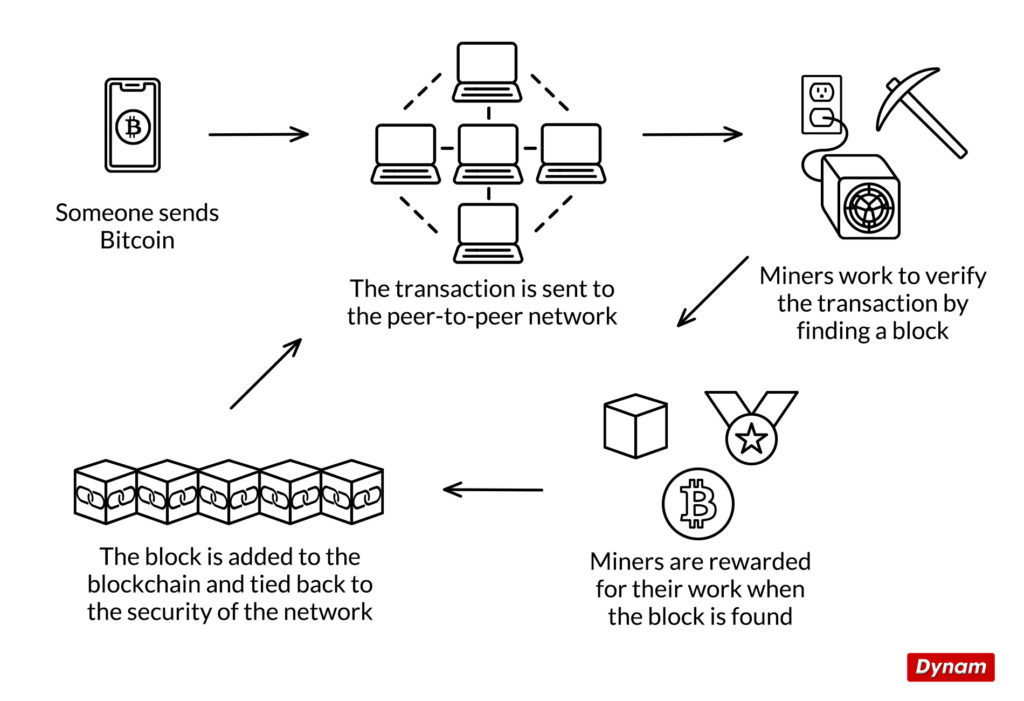

Bitcoin software is usually run on an individual computer to become part of the Bitcoin network as a miner, connecting to other computers running the same software. This software calculates what is called “hashes” which solve what is essentially a complex math problem. This math problem, created by the Bitcoin software across the network, balances out the network and the miners to keep things running smoothly. When the math problem is solved by a “hash” that is calculated by any computer on the network that is running the software, a new “block” is created as part of what is called Bitcoin’s blockchain. This block is linked to blocks previous to it and every block created after it will be linked as well – using cryptography. These blocks form a chain that serves as a permanent record of all transactions on the network that verify the authenticity of every amount of Bitcoin ever sent and received. At the same time, as a reward for using resources in the form of electricity and computing power to help keep the network online and secure, the operator of the Bitcoin software that correctly calculated the “hash” that generated the block is rewarded by the network automatically with 6.25 Bitcoin. It’s all up to chance which computer finds the correct hash, but all the computers on the network verify it using cryptography. The software automatically generates these new Bitcoins as part of the process of creating new blocks and disperses the Bitcoin as a reward to the miner for securing the network. This happens at set intervals with the network automatically adjusting itself to make sure blocks are always created approximately every 10 minutes. The operators of the software are essential “mining” Bitcoins by finding hashes and their action of mining through the software is what is keeping the network online and secure. The magic is that this is all happening at the same time and it’s all dependent on each other component. All these concepts work together in unison to make Bitcoin function securely. That might have still been a complicated explanation, so here’s a visual:

There’s a lot of computer science stuff going on in the background that makes all this work properly. Its development is rooted in philosophy, monetary policy, economics, and more.

You may be saying to yourself: “That’s the simple explanation?!” Sure, but if you were asked how email works many people could not articulate the technical underpinnings of that system. You don’t have to know how SMTP works to send an email! Likewise, you don’t have to understand exactly how blockchains work to send Bitcoin. Don’t worry, it’s much easier when you actually use it!

You can see transactions and statistics on the Bitcoin Blockchain at https://Blockchain.com/charts

Important Note: This is an easy way to see transactions on the Bitcoin blockchain. It is not recommended to use Blockchain.com to store Bitcoins or use Blockchain.com wallet services because of security considerations. More on that later but – just don’t do it!

How Bitcoins are Created

There will only ever be 21 million Bitcoins in existence. That’s how the system was designed. So once the system reaches that number, it will stop generating coins. Unlike other kinds of digital money, which can often be just created on a whim to serve a subjective need, Bitcoin has a hard cap that can’t be changed. This is in stark contrast to government issued money, for example, often pejoratively referred to as “fiat” currency by people the Bitcoin world. It’s called “fiat” because it’s often created by fiat – at the whims of bureaucrats in control of monetary policy as they see fit. This actually ends up devaluing currencies through inflation over time.

Regardless of your views on the political ramifications of these type of interventions, fiat changes to monetary policy can’t happen with Bitcoin like they can with government money like the United States Dollar or even the Zimbabwean Dollar, for example. The rules are hard coded in the Bitcoin software and the network keeps them secure and from being tampered with.

Bitcoin is designed to be scarce in the sense that there will never be more than 21 million of them in existence. About 18 million of them have been mined so far. That may seem like a lot, but the reality is that there are 7 billion people in the world, so not everyone could even own 1 whole Bitcoin. Since Bitcoin is divisible however, there is certainly the potential for everyone to be able to own part of a Bitcoin if it ever gained widespread, mainstream adoption.

The Bitcoin network creates Bitcoins automatically approximately every 10 minutes and disperses them to miners as a reward for running the bitcoin network. This concept is very important. This reward incentivizes people to keep the network running. It makes it profitable for people to mine Bitcoins, and miners are needed to keep the network online. Miners are rewarded.

This is so important because it involves concepts of game theory. People are unlikely contribute electricity that they themselves have to pay for to another cause for free. The creator of Bitcoin understood that people would not simply run the software out of the goodness of their hearts. While there are many people who run what are called Bitcoin nodes because they are enthusiasts and want to help secure the network (and probably make very little – if any – profit from it) the system was designed to incentivize people to run it, ensuring its security.

The more nodes and miners and the more distributed the network, the safer it is, because it’s harder to shut down. Bitcoin is at a point now where it would be virtually impossible to shutdown barring some incredibly unlikely catastrophic event like an EMP that knocked out electricity all over the world.

Mining Coins

It used to be easier to get into Bitcoin mining. Years ago you used to be able to buy special hardware or even build your own “mining rig” which used high-end computer graphics cards that would efficiently solve the hashes on the Bitcoin network.

These days professional mining operations with specialized computers handle most mining. Many miners combine their hashing resources to have a better opportunity at a mining reward. Their chances of finding a block go up when they pool their resources in the form of whats called a “mining pool.” It’s still possible to run a miner and help keep the Bitcoin network online from your own computer in your own home, you just wont get much money from it and it wont be adding much power to the network unless you have expensive specialized hardware designed to mine Bitcoin.

The Bitcoin network is measured in hash rates. The total combined network of Bitcoin is running at over 100 exahashes per second as of February 2020. Thats 100 quintillion – a lot of hash power. 100,000,000,000,000,000,000 hashes per second is what the total network operates at now and it’s usually growing.

This uses a lot of electricity. The system was intentionally designed this way because it enhances its security. Some people think this use of energy is wasteful. My view is that legacy financial institutions like credit card companies and banks are very wasteful when it comes to vehicles to transport cash, paper for documents in offices, office buildings that require lots of energy to keep running and heat and cool, among many other energy costs. And these legacy services inherently cannot provide the level of security, decentralization and many other benefits that Bitcoin naturally does by its very design.

Why Is Bitcoin So Novel?

Bitcoin solves a unique problem that for years was not solved in terms of transacting money.

It’s called the Byzantine General’s Problem and you can read more about it here. https://en.wikipedia.org/wiki/Byzantine_fault

The problem has to do with consensus of something that’s true without having to rely on the trust of other parties.

Bitcoin’s solution relies on technology, game theory, philosophy and economics.

But importantly, the way Bitcoin operates removes the need for trusting a third party in the transaction. It solves a lot of problems at once regarding trust, transfer, security, privacy, cost, and censorship.

The Price

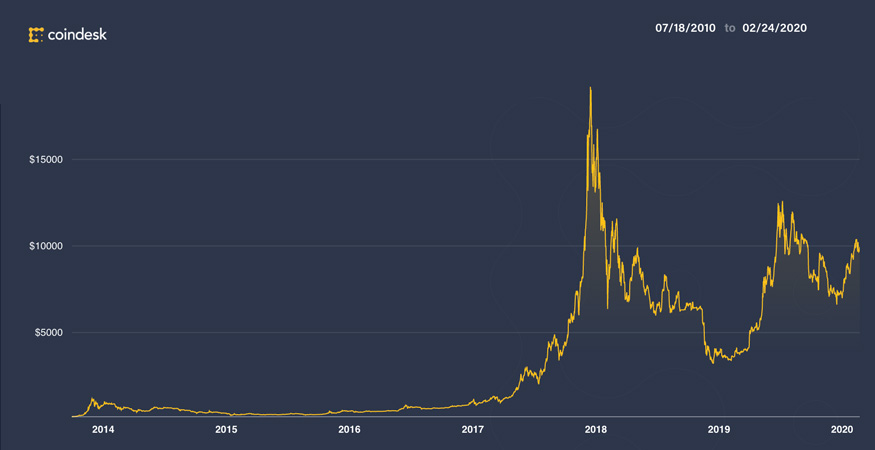

A Bitcoin is worth whatever anyone will pay for it. It trades like a foreign currency or a stock, although it is not a stock. For example, British Pounds trade against the dollar, Japanese Yen trade against the dollar, Chinese Yuan, Mexican Peso, Philippine Pesos, all kinds of currencies trade on markets. These Foreign Exchange markets – or Forex markets – fluctuate every day based on all kinds of world events and news. Bitcoin is similar, except you can trade it 24 hours a day, 7 days a week on various crypto exchanges such as Binance or Kraken. The Bitcoin network, and exchanges, never stop.

The price of 1 Bitcoin in dollars fluctuates based on lots of factors including news, world events, development of Bitcoin related technology, other trader’s activity and much more.

Bitcoin spiked big in 2013 when the country Cyprus was having problems with its financial system. The Cyprus government instituted restrictions that prevented people from withdrawing their own money from their bank accounts to prevent bank runs because of underlying issues with their financial system. If everyone tried to withdraw their money at once, it would have caused banks to run out of physical cash – a problem inherent to fractional-reserve banking. But the restrictions instituted by the government caused protests when citizens could not access their own money and were at risk of losing it due to the government policies.

This meddling with financial markets is one of the reasons Bitcoin was created. No matter how you feel about monetary policy or actions like this, when events like this occur in the world, it usually has an impact on Bitcoin.

On the other hand when negative news about Bitcoin breaks, it often moves the price of a Bitcoin downward. Different events impact the price and these events are rarely predictable.

Long term however, I believe in Bitcoin and that as more people come to understand its value proposition and many benefits, the price will increase even more over time.

The price is almost always measured in 1 Bitcoin or 1 BTC as an abbreviation. It will be “x Dollars per Bitcoin.” So when you see a price of 9,789.83, it means it costs $9,789.83 for 1 Bitcoin. Smaller denominations of Bitcoin also have names. In the same way $0.01 is called 1 cent, 0.00000001 BTC is called a “satoshi” named so, after Bitcoin creator Satoshi Nakamoto, for example. You can read more about Bitcoin units here: https://en.bitcoin.it/wiki/Units

The Creator

No one knows who Satoshi Nakamoto, the creator of Bitcoin, actually is. His writings on Bitcoin early on indicate his skill sets in computer science and philosophical positions on monetary policy. His communication on his usual Bitcoin development forums stopped years ago. But Bitcoin is bigger than him at this point. And it was designed that way. It has grown to be a very disruptive technology and because it brings the ability for some people to transact that previously were unable to – or outright blocked and prevented from doing so – Bitcoin’s creation has upset “the powers that be,” from world governments to companies like Western Union. Maybe Satoshi – whoever they are – was smart to remain anonymous.

Here’s the official Bitcoin White Paper written by Satoshi Nakamoto: https://bitcoin.org/bitcoin.pdf

You might think it’s unusual to use a currency created by someone or a group of people that no one knows. But Bitcoin doesn’t need Satoshi Nakamoto to operate. That’s how the system was designed. It’s trustless and distributed, it’s open source and anyone can read the code and understand how it works. That’s important. You don’t need to trust anyone else and believe what they are telling you is true. If you know how to read code, which anyone can learn to if they want, you can read the source code yourself and see how it works.

Either way Bitcoin is going mainstream. Here’s a recent clip from CNBC:

The Fun Part: Sending and Receiving Bitcoin

Bitcoin is sent and received using wallets and addresses. A wallet is like a collection of addresses. There are wallet apps for phones and various ways to make wallets. But if you’re storing cryptocurrency longterm and holding it as an investment, the easiest to use and most trusted and secure way currently is a hardware wallet.

If you’re serious about exploring the possibilities of Bitcoin and cryptocurrency, you need a hardware wallet. Hardware wallets keep your cryptocurrency safe and make it much easier to send, receive and keep track of your funds. They are a physical electronic device about the size of a regular flash drive and connect to a computer. They’re built with a computer chip called a “secure enclave” that keeps your coins safe and private.

There are smartphone apps that make it easy to create addresses for sending and receiving. If you’re a contractor accepting crypto for payment, these might work for you to generate an address to receive your payment. I know people who have used these apps without issue short term. However, I won’t endorse anything specific here. While the apps themselves are probably trustworthy, it could be possible for another app on your phone to record your screen or private activity and make it so your private keys are not really private. Someone could make a malicious app masquerading as a wallet app that really just steals your coins. I haven’t heard of anything specific like that, but it is possible. And that’s why I fall short of making a recommendation to use wallet apps on a phone. It can be done, I know of many circumstances where they have been used without issue, so if you’re going to do it, know this: I would only ever personally use them for short term transactions (generating a quick payment address and then quickly transferring to a hardware wallet after receipt of the funds) and never ever store any amount on them long term.

Hardware wallets are generally accepted as the best way to store and transact Bitcoin and other cryptocurrencies. They are called hardware wallets because they are actually a physical piece of hardware like a USB flash drive and approximately the same size as one – but with much different internal hardware that helps to keep your transactions safe.

There are 2 companies that I personally trust that make hardware wallets. So far, Bitcoin users on a very large scale have not had any problems with them and both of these companies put in safeguards that they are very transparent about.

Ledger and Trezor are widely trusted hardware wallet manufacturers.

Both companies compete with each other and often launch new features, new versions of devices, and firmware updates for their existing devices. You’ll want to look at their websites and see which best suits your needs. If you have questions on meeting a specific need, reach out, I can help.

However, I generally prefer Trezor’s products as I like the user experience they provide better.

All of the products made by these companies also support storing other cryptocurrencies at the same time as Bitcoin. They’re great devices.

If you are serious about doing anything with Bitcoin or cryptocurrency it’s well worth the $100 or so to get one of these hardware wallets.

It’s best to purchase hardware wallets directly from the manufacturer. Trezor and Ledger put many anti-tamper measures in place to prevent the device from being compromised, even protecting it on its way to you through the shipping process. Some crypto thieves are highly sophisticated and they put in a lot of effort to steal your coins.

So don’t just pick up a random hardware wallet on eBay. Never ever use a previously used or open box hardware wallet. Even a Trezor or a Ledger could be compromised by a seller on eBay. Only deal with trusted manufacturers directly. It’s just not worth losing all your money to try to save a few bucks on something that could be compromised.

When you set up a hardware wallet for the first time, you’ll set up a recovery phrase that will allow you to still access your coins in the event your hardware wallet gets lost or damaged.

Then the wallet software will generate a public address for you and corresponding private key.

Your public key/Bitcoin address is what you want to share in order for someone to send you money. This is where the payer sends the funds.

Hardware wallets simplify this. When sending, you’ll just input an address where you’re sending the funds and the amount you want to send. Usually fees will be automatic and are quite low. That’s it! Click the send button and the Bitcoin will be on its way.

This is important:

YOU NEVER WANT TO SHARE YOUR PRIVATE KEY WITH ANYONE ELSE!

Anyone else who has access to your private key has access to your funds. So never ever share your private key.

Always remember: If they’re not ONLY your keys, then they might as well not be your coins! Not your keys: not your coins.

The public address you must share with someone in order for them to send you money. It’s the address where they send the funds. Again, hardware wallets simplify this. It’s hard to share your private key using a hardware wallet, so that will help keep you safe.

Often times, addresses will be shared as QR codes that can be scanned by a smartphone app by using the device’s camera. QR codes may not have caught on in a huge way in the United States, but they’re actually a great way to quickly share complex information like a Bitcoin address.

This an example of Bitcoin at an address as seen on the blockchain. I picked a random one as an example. You can see how much Bitcoin is on the address but it’s unknown who owns it.

You – and anyone who wants to look it up – can see 7.175 BTC on this address above because the blockchain is a public ledger. But no one knows exactly who controls the address so there’s no reliable way to tell exactly who owns it. But you can see things like where it came from, or if and when it gets sent somewhere else. So it’s hard to know exactly who these transactions are going to, but because the blockchain is a public ledger you can see a trail of information.

Many Bitcoin experts consider it best practice to create a new address every time they receive a new payment. This prevents people from seeing how much total money you have if you left it all on 1 address. For example, if Client A pays you 1 Bitcoin to your payment address, and Client B pays you 2.5 Bitcoin to the same payment address, both of these clients would be able to see, by looking at the blockchain that there is 3.5 Bitcoin at that address, if they wanted to do so. And they know you own it, because they know that address belongs to you because you told them. Someone else looking at this address could see the 3.5 Bitcoin, but they probably wouldn’t be able to tell you specifically owned it, because your name and private information are not really tied to it. However, there are ways you can be tracked if you’re doing something you’re not supposed to, so don’t do that. Regardless, you may not want to divulge your total Bitcoin possessions to other people. That’s why many users create new addresses every time they receive payments. There are other reasons it’s good practice to create new addresses for transactions.

That’s up to you.

Just make sure you don’t make a typo and whoever is paying you doesn’t make a typo. If you send it to the wrong address, it’s probably gone forever. There are instances where the Bitcoin will come back if the address doesn’t exist, but honestly, I’ve never gotten into that situation and you don’t want to either. You should assume it won’t come back. Just double check that the address is correct!

An Example of a Bitcoin Public Address: 1Cqs2xQ4yK9sJzPS1BiCM3jtDt7sAz1J36

An Example of a Bitcoin Private Key: 5JKo6DKZjf7CHnFJV7eXuyrEL1gmNjQoQoQNAR5L5eNMQiQexFX

The Public Address and the Private Key are related to each other – by cryptography!

This is an example of a “Paper Wallet” that shows the public key and private key of a randomly generated Bitcoin address. You could send Bitcoin to this address, you should not, but you could, and anyone with access to the private key would be able to spend it. In the early days, these paper wallets were used as “cold storage” options for Bitcoin. They’re still usable, but are generally not considered safe anymore. If you want to find out more about them, BitcoinPaperWallet.org is the site, but I cannot recommend paper wallets now. Safer options are hardware wallets. You can read more about why here: https://en.bitcoin.it/wiki/Storing_bitcoins#Paper_wallets

You can create as many addresses as you like in your hardware wallet. Because of the way Bitcoin works with cryptography, new addresses can be generated all the time and it’s highly unlikely that 2 addresses will ever overlap.

Good ways to acquire Bitcoin

Coinbase and Gemini are good exchanges to get started in Bitcoin if you want to buy some and play around. These platforms rely on legacy financial institutions to convert dollars to Bitcoin. They will require identity verification because of this reliance and depending how much you plan to buy. This has nothing to do with Bitcoin itself. Remember, Bitcoin itself has none of these restrictions with identification or accounts to use once you have some, but if you want an easy way for an average user or beginner to start with owning some Bitcoin, these sites are generally trusted for a quick way to convert cash to Bitcoin. You’ll pay them in dollars and they give you an equivalent amount of Bitcoin.

Once you have Bitcoin in your account, withdraw it to your hardware wallet. Never ever, ever, keep your coins stored on a website. Ever. Websites that hold your coins can go offline overnight. Not only should you know that this can happen, but you should assume it will. It has happened before, many times, and people lost a lot of money. Take full control of your money, do not store it on a website!

Blockchain Technology and Further Developments

There’s often a lot of talk by Bitcoin skeptics that the real game changer is blockchain technology, the mechanism that keeps the Bitcoin ledger immutable and unable to be changed rather than Bitcoin itself. They say that blockchain technology itself is useful but they aren’t believers in Bitcoin as money. They often point to private blockchain implementations using blockchain to secure things in-house. For example, IBM has come up with its own blockchain implementation as an offering to businesses as part of its cloud computing suite.

The problem with this idea is there is no incentive mechanism that drives miners to run the network or keep it secure with a private blockchain. Bitcoin, by its inherent rewards structure, incentivizes users to keep the network online thereby ensuring its security. Without this incentive, private blockchains are not much different than a simple encrypted database. A huge advantage to Bitcoin is that once something is recorded on its blockchain it can’t be reversed. This has implications beyond just monetary transactions. Other information can be recorded in a block. And when it is, it is recorded in history forever, as long as Bitcoin is still running. So to me, a private blockchain by its very nature can never be as valuable as Bitcoin itself is.

But everyday there is a new development in cryptocurrency. We’ve already had forks in the blockchain that result in splits and new coins, and upgrades like Segwit in addition to the Lightning Network that is being worked on all the time. There are concepts that involve building on top of Bitcoin’s blockchain in a “Layer 2” solutions and not interfacing with the blockchain directly. Some of these methods plan to speed up transaction times and offer more functionality while using Bitcoin’s blockchain as the underlying foundation.

All of this development is the ultimate free market in action because anyone can use it, anyone can contribute, anyone can build on top of it, and the market decides the value of all of these developments.

Altcoins and Other Cryptocurrency

There are thousands of cryptocurrencies right now and more come into existence all the time. Many of them are very similar to Bitcoin in how they work with regards to sending and receiving payments. Some use different algorithms for mining, have different reward dispersement structures, or have completely different use cases that offer other functionality than Bitcoin.

When Bitcoin first started and alternative cryptocurrencies began to pop up to compliment or compete with it, they began to be known colloquially as “altcoins.” You can see hundreds of popular ones listed on CoinMarketCap and CoinGecko. These sites show charts and information on many cryptocurrencies with links to their respective websites.

These altcoins are usually created by a dev team or group of developers that have banded their resources together to create a coin they hope will become valuable.

One of the first ones was Litecoin meant to be a “silver” to Bitcoins “gold.”

Litecoin operates in much the same way as Bitcoin but with 4 times as many coins being in existence and a faster block confirmation time. However, its price is completely independent from Bitcoin. You might think 1 Litecoin would be 1/4 the price of a Bitcoin since there are 4 times as many but that’s not how it works exactly, lots of free market factors go into the price on any given day. There was a time when transaction times were slow on the Bitcoin network because of a spike in activity, and Litecoin prices surged because the market found value in Litecoin’s faster block confirmation times.

Many altcoins don’t have any real monetary value or any realistic value proposition and will probably never be worth any money.

But outside of some key differences in maybe the algorithm’s reward structure or the coins privacy features, the technical underpinnings of which involve cryptography are all very similar in the sense that these coins are all considered cryptocurrencies.

The free market decides the merits of all these altcoins, and many more:

Litecoin – similar structure to Bitcoin, based on Bitcoin source code with 4 times as many coins created and a faster block confirmation time

Ethereum – meant to be a programmable blockchain to be able to run what are called Dapps

Bitcoin Cash – an offshoot of Bitcoin that changes the underlying structure of the blockchain – controversial – I recommend avoiding this one due to confusion

Dogecoin – a meme coin that has very little actual value per coin, but sponsors a Nascar Car

Ripple – not a true decentralized coin, more of a digital currency. It’s centralized. It may have value over time since some financial institutions are interested in it, but it’s very different that Bitcoin

Libra – an announced but so far unreleased digital currency in development by Facebook, centralized

Monero – an extremely private cryptocurrency, marketed as totally untraceable

Many coins – and there are hundreds – were created through ICO’s or Initial Coin Offerings. ICO’s got their name from the psuedo-analogous Initial Public Offering which is when a company stock is sold to the public for the first time on the stock market.

Basically, startups and dev teams would trade a presale amount of their new coin for investment from anyone who wanted to contribute to the development of it.

There was a huge boom of ICOs a few years ago. The Securities and Exchange Commission didn’t like this, the process was classified as trading an unregistered security, and this practice has slowed down somewhat in the last few years in the US.

But that’s where many of these coins came from.

In terms of all cryptocurrencies, Bitcoin is still the biggest player. It would be unexpected for it to lose its top spot. It has the most hash power behind it and there are many good reasons it’s still the most popular. It’s the “O.G.”, the original cryptocurrency and already serves many purposes with a lot of hashpower behind its network. Many altcoins have come out trying to be the Bitcoin killer or offer some overly complex functionality. Often some of these coins are redundant to things that already exist and are swiftly rejected by the market. Sometimes there’s initial hype and then later they go to zero. It really all depends.

Accepting Altcoins

Chances are if you’re an independent contractor and you want to receive payment in cryptocurrency, it’s likely it will be Bitcoin. Or at least one of the big ones, like Etheruem or Litecoin. Crypto, as it’s called for short, is not mainstream enough yet to where clients would likely be paying in coins other than Bitcoin. It is possible though.

But if someone is offering to pay you in an unheard of cryptocurrency, it might be because they’re a startup and have developed their own coin and want to pay you in their own cryptocurrency. That’s something you have to decide if you’re comfortable with. If you really believe in the vision for the company, that might work for you. But you’re taking a risk because that coin could be worth nothing. People arrange all kinds of different deals all the time. Some people work for experience in something like an internship role, some people are willing to work for stock or equity. An arrangement with crypto may work for you.

Make sure the company is legitimate and you really believe in the altcoin they’re planning on sending you, otherwise it could be worth nothing, even in the longterm.

Risks

Not your keys, not your coins!

In the early days of Bitcoin many people got burned by having viruses or key loggers on their computer, keeping their coins on exchanges that got hacked or went out of business, not being careful with their wallets, other security issues, or just being downright careless and lazy. No one else can save you when it comes to Bitcoin. Transactions are irreversible. Theres no support number to call in the event of a theft or mistake. But you are in complete control. It’s incredibly empowering but some people can also find this overwhelming.

That’s up to you to decide.

I believe Bitcoin and cryptocurrency is the future. It’s too disruptive of a technology. By its very nature of not being able to be shut down and its accessibility, it has enormous potential to help many people all over the world and change lives for the better. Also, because of this potential and its limited supply of only 21 million, as it catches on, basic economic theory would dictate an expectation of an increase in value.

But another risk is that the price of Bitcoin is volatile. Sometimes the price goes up, sometimes it goes down. It’s constantly changing and some days are better than others. If you get paid $1000 in Bitcoin today, 0.10 BTC for example, that amount of Bitcoin could be worth $880 tomorrow. Or 0.10 BTC could be worth $1233 tomorrow. Sometimes there are big swings in only a day’s time. Sometimes the price of Bitcoin stays relatively the same for months. But if you believe in Bitcoin long term and think that over time – maybe years – the price will increase, holding on to it may pay off big time. Lots of people who got in early around 2010 and bought Bitcoins for pennies are very wealthy right now. Unfortunately, I didn’t even hear about Bitcoin until this early opportunity was long gone, so I’m not one of them.

The potential for this kind of huge return – or at least some substantial gains still exists for cryptocurrencies. It’s up to you to decide if it’s worth it to you or not. Some people think the opportunity for huge gains is over. Others think there’s much more room to grow and we’re still in the early stages with much higher numbers to come.

Another saying in Bitcoin is “don’t invest more than you can afford to lose.” It’s perhaps good advice for more than just Bitcoin but the reality is this technology is new, experimental and ever changing. It could all go to zero. Ultimately the free market will decide if anything in cryptocurrency is viable long term.

There are also definite risks in losing access to your coins. You could misplace your hardware wallet. Or if you aren’t careful, a simple typo could result in sending your coins to the wrong place. Sometimes they can come back. Most times they don’t. I like to triple check addresses before sending any transactions. Make sure anyone sending you funds is careful too! I’ve never had a problem, but even one wrong character will result in a loss.

Do not keep your coins on an exchange! Ever!

Unless you’re day trading or willing to lose them all, don’t keep your coins on an exchange. Or really anywhere else where you aren’t the only one with access. Exchanges, online wallet services, and the like can all be hacked and/or shut down over night. It has happened before. Remember: not your keys, not your coins.

Although I’ve never personally had an issue losing cryptocurrency to theft or user error, I know someone who had altcoins on an exchange back in the day that disappeared after the website got hacked. It wasn’t Mt. Gox, although that was a high profile similar situation, but any of these exchanges can disappear overnight for any number of reasons.

If you’re the only one holding onto the coins on your own private wallet that only you have access to, that can’t happen.

Even when you’re using a hardware wallet, you’re trusting the company who made it. If somehow they programmed a backdoor into the device or have some way to steal your funds that you aren’t aware of, they could do so without you knowing. Both Ledger and Trezor go to pretty great lengths to prove that they aren’t doing this. Again, they are widely trusted companies.

All of this may seem overboard, but you can’t be too careful when it comes to cryptocurrency security. You don’t want to lose access to all your funds because of an easily preventable mistake. It’s not that hard once you get used to it, you just have to know what to watch out for.

There was a story about someone purchasing a hardware wallet from a reseller on eBay. The seller put fake instructions in the box with a recovery seed that they themselves (the seller) had access to. When the buyer put their coins on the device, the seller was able to steal them using the known recovery seed. They essentially tricked the buyer, but because the buyer didn’t know better and was not the only one with that recovery seed, they got scammed and lost their coins to theft. eBay won’t help you in a situation like this. That’s why you shouldn’t just trust anyone when it comes to cryptocurrency security.

There are also many sites to beware of. For example, the site Bitcoin.com was taken over by an influential name in Bitcoin, that created an offshoot of Bitcoin called Bitcoin Cash. Bitcoin is not the same as Bitcoin Cash. This caused a huge rift in the Bitcoin mining and development community a few years ago. There were disagreements on how to build upon the Bitcoin protocol and this split and Bitcoin Cash was the result of it. Many in the Bitcoin world disagree with this persons philosophical view, and the way he created a split in Bitcoin by making this new currency. So while some might think Bitcoin.com might be a good resource for information, the reality is it’s probably doing some marketing work for the owner’s altcoin, Bitcoin Cash – it’s biased. That doesn’t mean you should avoid differing points of view, but it does mean as you get deeper into cryptocurrency, you’ll see people have different opinions on how things are supposed to work. Bitcoin.org is a better resource for relatively unbiased information and I personally err on the side of the creator of Bitcoin Satoshi Nakamoto, because I believe in the reasons for Bitcoin’s creation.

Avoid something called cloud mining. Cloud mining is when you pay a cryptocurrency mining company to use their specialized mining hardware to mine cryptocurrency in the hopes of acquiring a cryptocurrency you choose. You’re better off purchasing coins directly. While cloud mining can work, it’s usually sketchy because you pay the company money, but don’t actually see their mining hardware. You’re better off buying the cryptocurrency than trusting a mining operation to pay out more money to you than you’re paying them to mine things on your behalf. When you buy into cloud mining, you’re really funding in a company’s investment in hardware and their own management of it, in the hopes you’ll get a return without any guarantee they are operating in your interest at all. It’s not worth it. And unless you really know what you’re doing, mining yourself with your own mining rig or hardware isn’t worth it either. Unless you get free electricity. Even then, it will take a long time for your investment in the mining hardware to pay off. You’re better off just buying whatever coin you wanted to mine outright.

But the most important thing to remember to make sure your money stays yours is this:

If you aren’t the only one with access to the private keys, they might as well not be your coins. Not your keys: not your coins!

Information and opinions won’t hurt you, as long as you’re keeping your keys safe.

Just remember: If they’re not ONLY your keys, then they’re not your coins!

Money, just a transactional vehicle

Some Bitcoin skeptics like to talk about how Bitcoin can be used for bad things. All forms of money can be used for good or bad. There’s not much evidence to support that Bitcoin or cryptocurrency is used for illicit activities at a higher rate than other types of money. In fact, a lot of the numbers support the opposite. US Dollars in cash are used for a lot of illegal activities. Regardless, if you’re trying to do something you shouldn’t be doing and want to use Bitcoin, that’s not a great idea. While there are privacy protections built in, it’s not completely untraceable. The blockchain is after all a public ledger.

The government could ban Bitcoin. There are no plans to do that in the US. But it could happen. However, that wouldn’t stop it. They could shut down exchanges that change dollars to Bitcoin, and in fact this has happened in some countries. But Bitcoin itself can’t be stopped. Even if the government “banned” it, the network would continue to operate and you could still transact with internet access. They would have to shut down the internet to stop Bitcoin.

That’s not going to happen, and if it does, there will be a lot more problems than lack of access to Bitcoin.

Is Bitcoin for you?

Many Bitcoin skeptics are out there promoting what they perceive as downsides to the technology. However, the more research I personally did, the more I was interested in it. Every time a negative point or potential downside arose in my research, a counterpoint, answer, or innovation solved it. There was always a more than adequate answer to my many, many questions and my own skepticism. Every issue I thought of was always explained and solved. Then through usage and experimentation I became a firm believer and advocate.

Bitcoin is an extremely well thought out and conceived technology solution. It may not be for you, and that’s ok. But it’s clearly a disruptive technology and I personally believe it has enormous potential to help those less fortunate and disenfranchised in developing nations and all over the world. That is just the beginning. The technological applications are limitless.

It’s Easy

All of this is not as complicated as it sounds. Once you start using Bitcoin, it’s actually pretty straight forward. It’s just best practice to have a good foundation before you start so I wanted to cover basics and common questions.

There’s so much information and many great resources out there. If you’re looking for a reliable, deep dive in readable form you can start with the official Bitcoin wiki at https://Bitcoin.it

Here’s the official Bitcoin White Paper written by Satoshi Nakamoto: https://bitcoin.org/bitcoin.pdf

Also, arguably the most influential name in the Bitcoin world is Andreas Antonopoulos. He has tons of great content and YouTube videos on Bitcoin – he’s a true expert and he helps to explain things in ways that are easy to understand. Search “aantonop” on YouTube.

Thanks

I was encouraged to make this guide by my good friend Ben Burns over at The Futur. Ben along with Chris Do and their team at The Futur are doing some awesome, awesome things helping designers and entrepreneurs be successful by teaching amazing strategies through their videos, advice, and incredibly educational courses. You’ll learn more from their YouTube videos alone than most college courses. Seriously, check out what they have to offer. I’m a highly experienced designer and the implementation of their teachings in my own business has resulted in nothing but positive outcomes.

It’s likely you have even more questions after reading this article. That’s awesome! Feel free to reach out. I love to discuss Bitcoin and crypto and would be happy to answer any questions and even expand on this guide if you think there’s something I missed that needs more explanation.

If you know anyone who would benefit from this guide, please share it.

And if you’re a business that would like to learn more about Bitcoin, accept cryptocurrency as payment option, or want to have something cool built that involves cryptocurrency, let me know, we’d love to help you.

Resources:

Official Bitcoin Wiki:

https://Bitcoin.it

Official Bitcoin White Paper:

https://bitcoin.org/bitcoin.pdf

Exchanges to buy Bitcoin directly:

https://Coinbase.com

https://Gemini.com

Websites for charts and top coins:

https://CoinMarketCap.com

https://CoinGecko.com

Hardware wallets:

https://Trezor.io

https://Ledger.com

Andreas Antonopoulos:

Andreas Antonopoulos on YouTube